Understanding Transfer Pricing Compliance in the UAE

The introduction of Corporate Income Tax in the UAE has brought Transfer Pricing rules into effect, marking a significant shift in tax compliance. These rules will have a considerable impact on most businesses in the UAE that engage in transactions with group companies or make payments to owners and directors.

In this article, we aim to explain the concept of transfer pricing and the compliance requirements and obligations that businesses in the UAE must adhere to. The Transfer Pricing regulations are established by the UAE’s Corporate Tax Law and Ministerial Decision No. 97 of 2023.

At its core, transfer pricing addresses how prices are determined for transactions between businesses and their Related Parties or Connected Persons. These entities and persons can include companies within the same group, those with common shareholding, or even transactions and payments to business shareholders, directors, and their relatives.

Typically, when two independent companies engage in business transactions, prices and terms are influenced by market dynamics and negotiations. However, when related businesses conduct deals, they may not be subject to the same market pressures. This can lead to the establishment of prices that deviate from what would be expected in a normal market situation. This practice is often used to shift profits from a high tax rate to a low tax rate jurisdiction to minimize taxes, or reduce the taxable profit by paying high salaries to Connected persons. That is why the concept of the Arm’s Length Principle is introduced.

The Arm’s Length Principle

Central to transfer pricing is the concept of the arm’s length principle. This principle stipulates that transactions between Related Parties or Connected Persons should reflect what unrelated entities would agree upon in similar circumstances. In other words, prices and terms must be fair and impartial, just as they would be in a truly independent business transaction.

“Transactions or arrangement between Related Parties or Connected Persons whether conducted domestically or cross borders, must follow the Arm’s Length Principle”

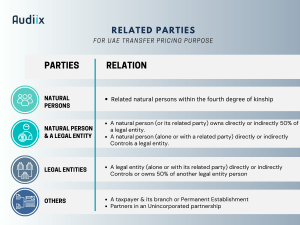

Having explained the concept of Transfer Pricing, we will now explore the identification of Related Parties and Connected Persons. This is important for businesses as they must ascertain these relationships to determine the pricing of transactions or payments involving them, ensuring compliance with corporate tax regulations.

Related Parties

Transfer pricing is focused on transactions involving Related Parties and Connected Persons. These relationships can appear in various ways, including familial connections, ownership interests, control, and partnerships. Recognizing and understanding these associations is critical, as they have a significant impact on pricing and specific tax deductions. The table below provides a visual representation of related parties:

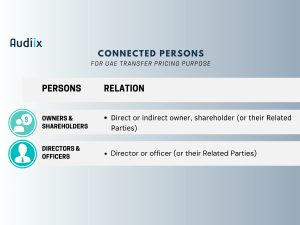

Connected Persons

In the context of UAE corporate tax, “Connected Persons” encompass a range of individuals, including owners, shareholders, and directors, along with their Related Parties. When it comes to payments or benefits made to these Connected Persons, they are deductible for Corporate Tax purposes only if they align with the Arm’s Length Price, which represents a fair and impartial value.

However, there is an exception to this rule. No restrictions apply to payments made to Connected Persons of a publicly listed or regulated company.

The table below provides a visual representation of Connected Persons:

Salaries & Payments to Connected Persons

In the absence of personal income taxation in the UAE, individuals may be tempted to generate incentives by directing excessive payments to themselves or individuals connected to them. To maintain tax compliance, businesses must demonstrate that any payments or benefits provided to Connected Persons correspond to the market value of the services rendered. Moreover, these payments or benefits should be incurred wholly and exclusively for the purpose of the taxpayer’s business.

Scope of Transfer Pricing Rules

The UAE’s transfer pricing rules apply to transactions involving Related Parties and Connected Persons. However, it’s important to note that exempt entities and those that have elected for small businesses relief still need to meet the Arm’s Length Principle but are not obligated to prepare extensive transfer pricing documentation.

Transfer Pricing scope covers ‘Controlled Transactions’ These transactions refer to any transaction or arrangement involving Related Parties or Connected Persons whether conducted cross-border or domestically including transactions between free zone entities. Controlled Transactions can encompass a broad spectrum of activities, including:

- Trading Tangible Goods: Involving the sale and purchase of physical products.

- Services: the provision and receipt of various services.

- Financial Activities: Covering funding and other financing transactions.

- Utilization of Intangible Assets: Involving the commercial exploitation of patents, brands, and know-how.

Application of the Arm’s Length Price

When dealing with transactions involving related parties or connected persons, businesses must follow a clear, three-step process to ensure they meet the Arm’s Length Principle:

- Identify and Analyze: Begin by identifying Related Parties, Connected Persons, and relevant transactions. Perform a comparability analysis to assess the fairness of the prices and terms.

- Choose the Right Method: Select the most suitable Transfer Pricing Method. This method should align with how independent businesses would price similar transactions under normal market conditions.

- Determine the Fair Price: Calculate the Arm’s Length Price, which represents the price that unrelated parties would agree upon in a comparable situation.

It’s worth noting that this analysis can be complex, and seeking guidance from a professional tax advisor is advisable to navigate it effectively.

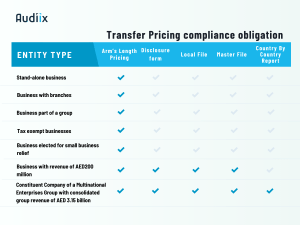

Transfer Pricing Documentation and Reporting Obligations

Transfer Pricing Documentation is a mandatory requirement for businesses that are Constituent Companies of a multinational group with a total consolidated group Revenue of AED 3.15 billion or more in the relevant Tax Period, or where the Taxable Person’s Revenue in the relevant Tax Period is AED 200 million or more.

The documentation serves three primary objectives:

- Compliance: It ensures that businesses set fair prices and accurately report controlled transactions on their tax returns.

- Risk Assessment: The documentation aids the Federal Tax Authority (FTA) in assessing transfer pricing risks, determining the need for potential audits.

- Audit Facilitation: In the event of an audit, the documentation provides the FTA with essential information for a comprehensive examination of a business’s transfer pricing practices.

The documentation includes:

- Transfer Pricing Disclosure Form: Details of Controlled Transactions, details of the Related Parties and the Transfer Pricing method used to determine the arm’s length price. Filed with tax return.

- Master File: A 75-150 pages word document provides an overview of the group structure, income allocation, intangibles, financial activities & arrangement, and tax positions. Prepared globally, but with an obligation on the local entity, and filed upon request, within 30 days.

- Local File: A 50-100 pages word document, provides detailed information about transactions with Related Parties, Transfer Pricing methods applied, and comparability analysis. Prepared and maintained locally, on legal entity basis, and filed only upon request, within 30 days.

- Country-by-Country Report: usually in form of tables, provides jurisdictional quantitative data about a multinational enterprise (MNE) group. Prepared globally and submitted on annual basis.

The table below shows obligations level for different types of businesses:

Audiix Insight

The introduction of Transfer Pricing rules signifies a profound transformation in tax compliance in the UAE. It presents a new challenge for taxpayers and has a wide implications for a majority of UAE businesses.

The impact of Transfer Pricing will affect businesses that engage in transactions with group companies, whether these entities are within the UAE or in international jurisdictions. The effect will extend also to owners and directors who receive payments related to business activities.

The consequences of falling to meeting these requirements should not be underestimated. Non-compliance could leads to substantial adjustments to taxable profits, potentially resulting in additional tax liabilities.

The documentation and reporting requirements introduce a considerable compliance burden for many taxpayers. Master files and local files, which are integral components of compliance, are intricate documents that demand a significant investment of time and effort to assemble accurately.

Transfer Pricing compliance has a specific effect on free zone companies, as a free zone company may lose its status as a Qualifying Free Zone company if it fails to meet the transfer pricing conditions.

We strongly recommend that UAE businesses meticulously determine the extent to which Transfer Pricing applies to their operations. It’s important to identify transactions that involve Related Parties and Connected Persons and thoroughly assess them to ensure they comply with transfer pricing requirements

Elsir Badri,

Partner,

FCCA, MBA, CMA, UAECA, Tax Agent.