Corporate Tax Registration Timeline in the UAE

The UAE’s Federal Tax Authority (FTA) has issued Decision No. 3 of 2024, establishing clear guidelines for the corporate tax registration timeline and associated penalties. This article aims to guide you through these critical deadlines, tailored to various types of business licenses.

Firstly, the implementation of the new deadlines significantly impacts the timeframe businesses have to comply with their Corporate Tax registration obligations. For example, certain entities are required to file their Corporate Tax registration applications by 31 May 2024 to avoid potential penalties. Additionally, newly formed Companies must ensure their registration is completed within three months following their date of incorporation.

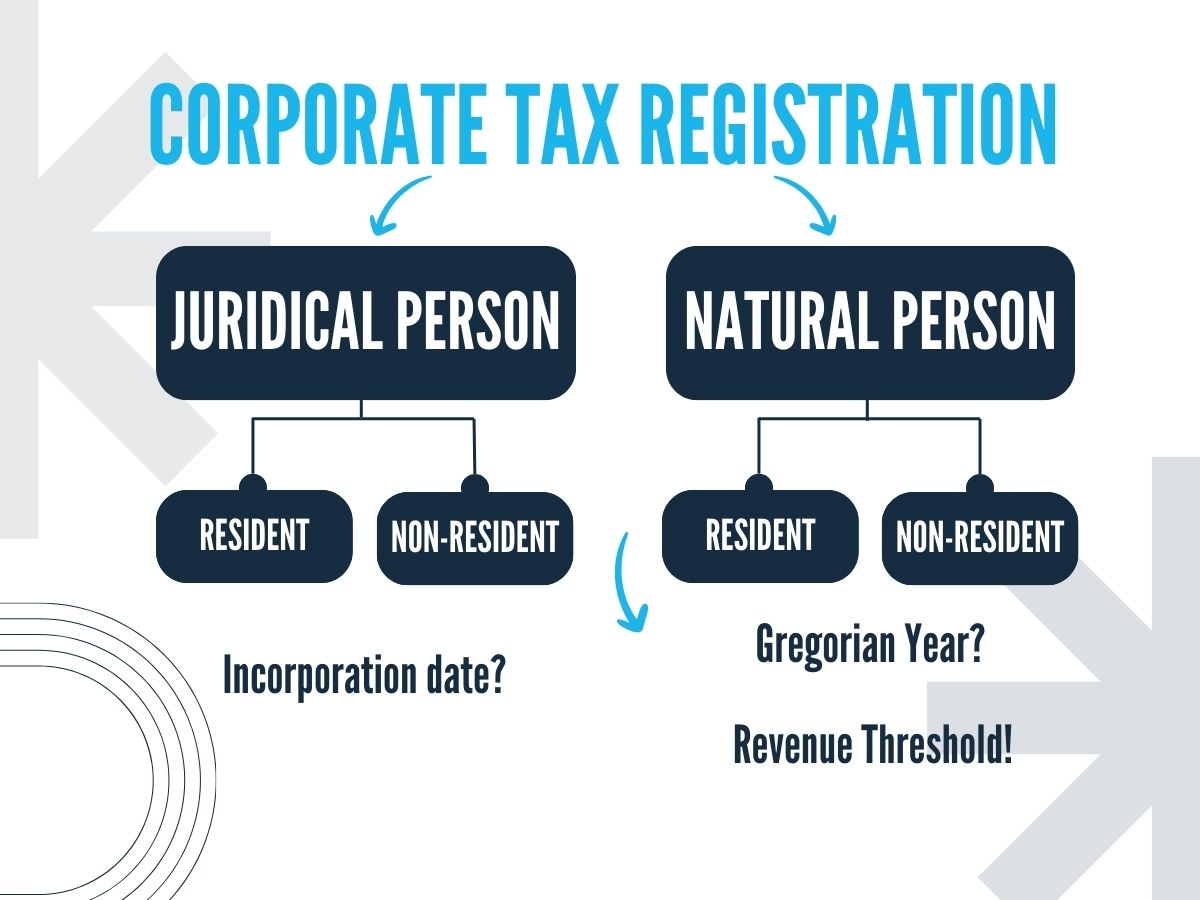

Businesses, particularly those pending registration, must be aware of their specific deadlines for submitting Corporate Tax registration applications, which vary based on their business license type such as sole establishment of limited liability company. The FTA has established precise deadlines for both natural persons and companies, underlining the critical need to understand these schedules to ensure timely compliance.

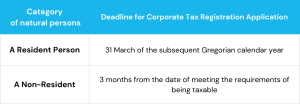

Natural Persons

For UAE tax purposes, individuals engaged in business activities under licenses such as sole establishments, sole proprietorships, and freelance permits are recognized and registered as natural persons. Typically, these forms of business carry unlimited liability. Such natural persons with an annual turnover exceeding AED 1 million are subject to specific registration deadlines, which are determined by their tax-residency status.

Resident Juridical Persons

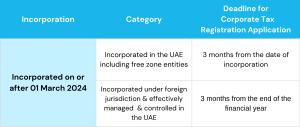

These include entities such as limited liability companies incorporated within the UAE. The registration timeline is primarily divided into two categories: those established before March 1, 2024, and those founded thereafter.

1) Entities already Established or Incorporated Entities

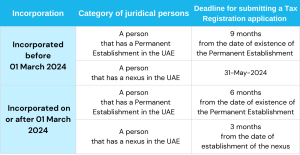

Entities incorporated before 1 March 2024 must register according to the timeline that correlates with their license issuance month, as outlined below:

2) Entities Incorporated on or After 1 March 2024

Non-Resident Juridical Persons

For foreign legal entities that have a permanent establishment or a nexus in the UAE, the deadlines vary based on their establishment date:

Penalties for late registration

In a recent update, Cabinet Decision no. 10 of 2024, instituted a penalty of AED 10,000 for delayed submission of the corporate tax registration application.

Key Takeaways

The FTA’s methodical approach to corporate tax registration is clearly designed to streamline the process for businesses across the UAE.

Businesses must proactively manage their registration obligations within the designated timelines and remain vigilant of the penalties for late registration.

Corporate Tax registration is now an integral part of the process for establishing new corporations. Unlike VAT registration, which requires meeting specific thresholds, resident juridical entities must apply for Corporate Tax registration within three months from the date of their incorporation, establishment, or recognition.