Is Your Free Zone Business Eligible for 0% Corporate Income Tax?

Introduction

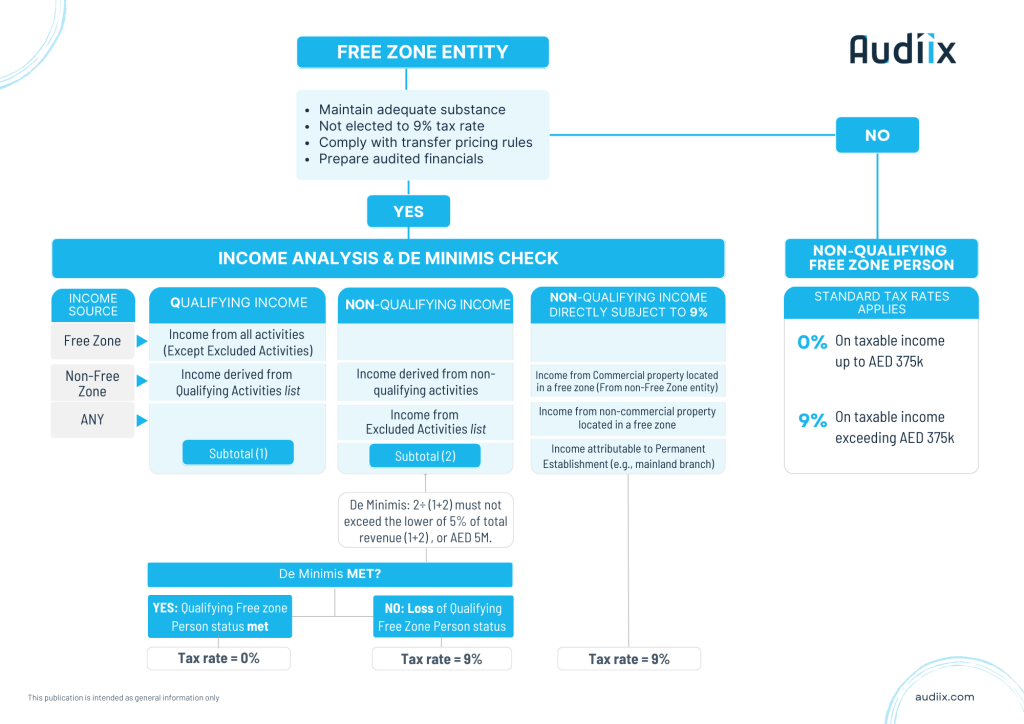

The United Arab Emirates (UAE) has implemented the Corporate Tax Law (CTL), which mandates a corporate tax rate of 9% on income that exceeds AED 375,000. However, Free Zone companies have the opportunity to enjoy a 0% corporate tax rate, provided they fulfill specific criteria. The main criteria include being recognized as Qualifying Free Zone Persons (QFZPs) and generating Qualifying Income.

For Qualifying Free Zone Persons (QFZPs), the corporate tax rate applicable to their qualifying income is set at 0%, while any non-qualifying revenue is subject to the standard 9% rate. This article aims to provide a comprehensive explanation of all the conditions and requirements, encompassing aspects such as qualifying free zone companies, qualifying income, qualifying activities, and excluded activities.

What Constitute Qualifying Free Zone Person (QFZP) for Corporate Tax

For Free Zone companies to be a Qualifying Free Zone Person and benefit from the favorable tax treatment, all the following conditions must be met.

-

- Maintaining adequate substance in the State: The QFZP should primarily conduct its income-generating activities within a Free Zone. The level of activities carried out should be substantial, supported by adequate assets, a sufficient number of qualified employees, and significant operating expenditures

- Deriving Qualifying Income (see below)

- Not electing to be subject to corporate tax at the standard rate of 9%

- Compliance with the Arm’s Length Principle and Transfer Pricing Documentation (in relation to transactions with related parties and connected persons)

- Meeting the De Minimis Requirements (non-qualifying Revenue does not exceed certain thresholds)

- Preparation of audited financial statements

Ceasing QFZP Status for Non-Compliance

It is essential to note that if a QFZP fails to meet any of the above conditions at any given time, it will cease to be recognized as a QFZP from the beginning of the relevant Tax Period and for the subsequent four Tax Periods.

To provide clarity on the application of the Corporate Tax Law to Free Zone Persons, the UAE Ministry of Finance released two key decisions: Cabinet Decision No. 55 of 2023, determining Qualifying Income for QFZPs, and Ministerial Decision No. 139 of 2023, outlining Qualifying Activities and Excluded Activities. These decisions establish the criteria for determining the eligibility of Free Zone Persons as QFZPs and shed light on the tax treatment of their income and activities

Income Analysis

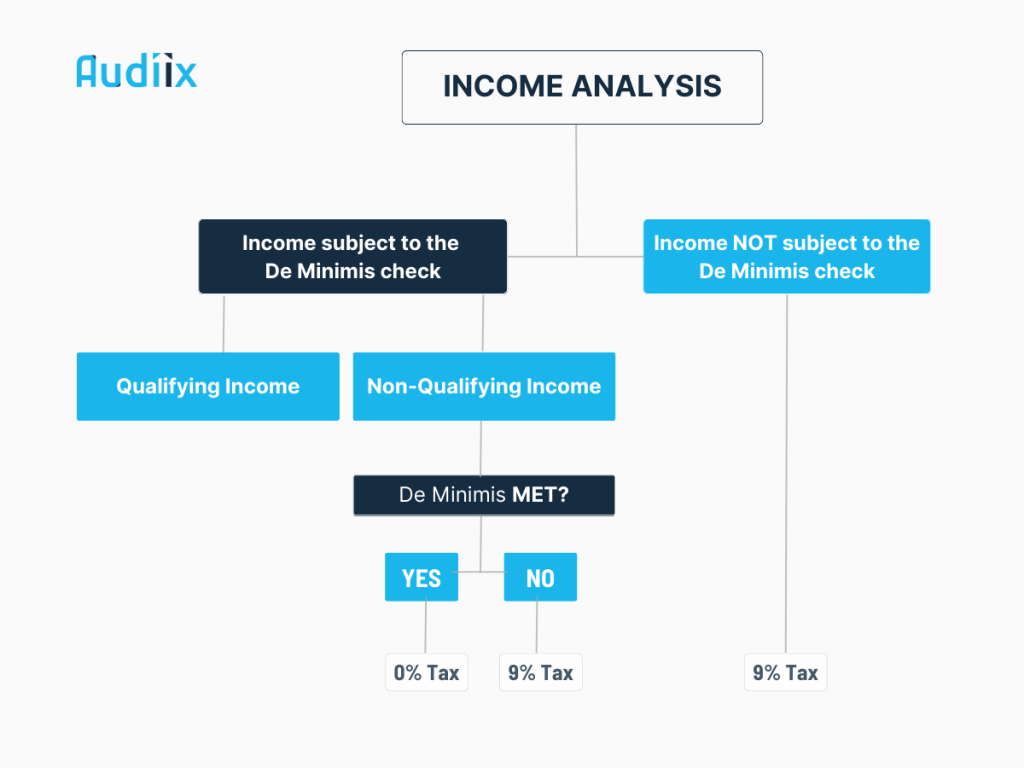

Key factors in determining whether a free zone entity qualifies for a 0% corporate tax rate are deriving qualifying income and meeting the De Minimis requirement. The De Minimis requirement is met if non-qualifying income does not exceed the lower of 5% or AED 5 million of the total revenue.

To determine these factors, a thorough analysis of qualifying and non-qualifying incomes must be conducted, considering the source of income, transaction parties, lists of qualifying and excluded activities, and the percentage or amount of non-qualifying income in relation to the total income.

To simplify this analysis, we suggest categorizing the free zone entity’s income into two categories:

- Excluded Income (Not subject to De Minimis Test:

- Qualifying & Non-Qualifying income (Subject to De Minimis Test)

This category includes non-qualifying income directly subject to 9% tax and should not be included in the total income for the purpose of the De Minimis check. These are:

- Income from commercial real estate property in a free zone, if generated from a non-free zone entity.

- Income from non-commercial real estate property located in a free zone.

- Income attributable to a Permanent Establishment (local or foreign), such as a mainland branch of a qualifying free zone entity.

Income subject to to De Minimis Test

The category of income subject to the De Minimis Check includes both qualifying and non-qualifying income that need to be considered. If the De Minimis requirement is met, the entire category will be subject to a 0% tax rate. However, if the De Minimis requirement is not met, the free zone entity will be disqualified, and the entire category will be subject to a 9% corporate tax rate

Qualifying Income

Under the Corporate Tax Law, Qualifying Income of a QFZP is taxed at a rate of 0%. The decisions issued by the Ministry of Finance provide guidance on what constitutes Qualifying Income for a QFZP:

- Income derived from transactions with other Free Zone Persons: This includes revenue generated from transactions with entities operating within Free Zones, excluding income derived from Excluded Activities (listed below).

- Income derived from transactions with Non-Free Zone Persons: QFZPs can also generate Qualifying Income from transactions with Non-Free Zone Persons, but only if these transactions pertain to the list o Qualifying Activities and are not classified as Excluded Activities.

- Income from immovable commercial properties located in a Free Zone where the transaction is conducted with a Free Zone Entity.

- Other income: QFZPs can potentially generate Qualifying Income from other sources, provided they meet the specified De Minimis test Requirements.

Qualifying Activities

Those are specific activities conducted by a QFZP from which Qualifying Income is derived. These activities include:

- Manufacturing of goods or materials.

- Processing of goods or materials.

- Trading of qualifying commodities

- Holding of shares and other securities for investment purposes

- Ownership, management and operation of Ships.

- Reinsurance services that are subject to the regulatory oversight of the competent authority in the State.

- Fund management services that are subject to the regulatory oversight of a competent authority.

- Wealth and investment management services that are subject to the regulatory oversight of the competent authority in the State.

- Headquarter services to Related Parties.

- Treasury and financing services to Related Parties.

- Financing and leasing of Aircraft, including engines and rotable components.

- Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale. (the activity of distributing goods or materials must be undertaken in or from a Designated Zone and the goods or materials entering the State must be imported through the Designated Zone.)

- Logistics services.

- Any activities that are ancillary to the activities listed above. (an activity shall be considered ancillary where it serves no independent function but is necessary for the performance of the main Qualifying Activity.

Excluded Activities

- Transactions with natural persons, except for transactions related to certain Qualifying Activities.

- Banking activities subject to regulatory oversight in the UAE.

- Insurance activities subject to regulatory oversight in the UAE, excluding reinsurance services.

- Finance and leasing activities subject to regulatory oversight in the UAE, excluding certain financing and leasing of aircraft.

- Ownership or exploitation of immovable property, except for commercial property in a Free Zone involved in transactions with other Free Zone entities.

- Any activities that are ancillary to the activities listed above.

Meeting the De Minimis Test

Non-qualifying Income is derived in a tax period from any f the following:

- Excluded Activities; or

- Activities that are not Qualifying Activities derived from transactions with a Non-Free Zone Person.

Conclusion

The recent decisions issued by the UAE Ministry of Finance provide much-needed clarity on the taxation of Free Zone Persons under the new Corporate Tax Law. To ensure compliance and benefit from the 0% corporate tax rate on Qualifying Income, businesses operating in Free Zones should carefully review the criteria outlined in the decisions.

Next Step

To ensure smooth implementation of corporate tax, Free Zone entities are advised to take the following steps, preferably before registering for corporate tax:

- Assess their eligibility for Qualifying Free Zone Person (QFZP) status.

- Evaluate the ratio of qualified income to non-qualified income.

- Analyze the income derived from properties in both the Mainland and Free Zone.

- Evaluate the income associated with permanent establishments located outside the Free Zone.

- Assess the income generated from transactions with entities within and outside the Free Zone.

- Determine whether their activities align with the list of qualified or excluded activities.

- Make a final determination on whether they are subject to a 9% or 0% tax rate.

- Plan their taxes and finances accordingly.