Want to achieve tax compliance?

Appoint an FTA

listed Tax Agent

Share the risk by linking your FTA account with a tax agent to officially represent you and file tax returns on your behalf

Your tax done right & on time

- Compliance and peace of mind

- Efficiency and tax savings

- Paperless & hassle free tax filing

Our Tax Agent Service Plans

Standard

Get a tax agent package specifically devised for your small businesses

- VAT Registration

- Corporate tax registration

- VAT return filing

- Quarterly VAT report

Premium

All your tax done! with tax agent plan for VAT and corporate income tax compliance

- Tax agent appointment

- Tax advisory & support

- VAT return filing

- Corporate tax registration

- Corporate tax filing

Need a tailored plan?

Contact us today

The advantages of appointing a Tax Agent

- Representation before the Federal Tax Authority

- Expert assistance with tax obligations and rights

- Advance advisory for maximizing VAT recovery

- Mitigating risks and liabilities with authorized professionals

Why Audiix

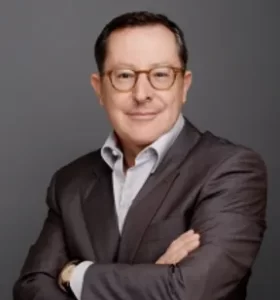

“Working with Audiix is a real pleasure. They are efficient and budget-friendly, I highly recommend them.”

Elissa Freiha, Founder

Womena

FTA listed tax agency

Personalized support

Hassle-free experience

Your Business Deserves the best

Contact us today!

tax@audiix.com

+971 50 52 800 12

Got questions?

We've gathered some answers

A Tax Agent is a person authorized by the Federal Tax Authority (FTA) and listed in the tax agents register, who can be appointed by businesses to represent them before the FTA and to assist them with their tax obligations and exercising their tax rights.

Tax agent meets many approval requirements such as accredited qualifications, VAT diploma, good conduct certification and indemnity insurance. In addition, he has a fiduciary duty to maintain the confidentiality of any information obtained during performing his tasks.

Assist businesses with their tax obligations and communications with the Federal Tax Authority.

Filing returns on client’s behalf via official appointment and electronic linkage.

Provide professional and comprehensive tax advisory services.

Represent businesses before the FTA to meet their tax obligations and to excercise their rights.

Share the risk of any mistakes on return filing. The tax agent will file your tax return from his own FTA accounts not yours.

Insured against professional liabilities and errors.

Expert’s advice from a qualified tax professional, holder of GCC VAT Diploma issued by the Association of Tax Technician (UK) and approved by the FTA.

What our clients says

We take pride in the positive impact we’ve made on the business journeys of ambitious entrepreneurs in the UAE. Hear it directly from our clients how our accounting and tax services have played a crucial role in their growth and achievements.

Ahmad Saqer, CFO

"Audiix provided a total solution of bookkeeping, financial reporting, software and Tax Agent services. We are now more efficient. We saved resources, talent and time."

Aisha Leitner, Founder

"We are very happy with Audiix services and would not hesitate to recommend them to anyone."

Fadi Sidani, CEO

Olivier Bauchart, GM

Hajjaj, CEO

Audiix promised and delivered a comprehensive package of bookkeeping, reporting &VAT services, with fewer steps and minimal paper